Pension funds are leaving the Ukrainian market en masse: what about savings.

The system of non-state pension provision in Ukraine is in poor condition. According to the research by NCSSP advisor Serhiy Zubyk, since 2003, more than half of non-state pension funds have ceased operations.

'The exit from the market of many pension funds was accompanied by the loss of personalized accounting, and sometimes even the pension funds of their participants,' emphasizes the expert in his article 'It is Time for an honest discussion about the ability of NPFs to service pension savings.'

According to the latest data, out of 59 registered NPFs, five do not submit reports, and three are in the process of liquidation.

The situation with assets is also concerning - the total value of pension assets of all NPFs is only 5.3 billion UAH, with the majority of this amount held by the corporate NPF of the National Bank of Ukraine.

It is particularly critical that the assets of every third NPF do not even reach 1 million UAH.

In the scale of the entire voluntary individual pension provision system, which covers 886.6 thousand people, each participant has just over 6 thousand UAH in pension savings, which calls into question the effectiveness of the non-state pension provision system in Ukraine.

Previously, the PFU explained how much work experience is needed to retire.

Read also

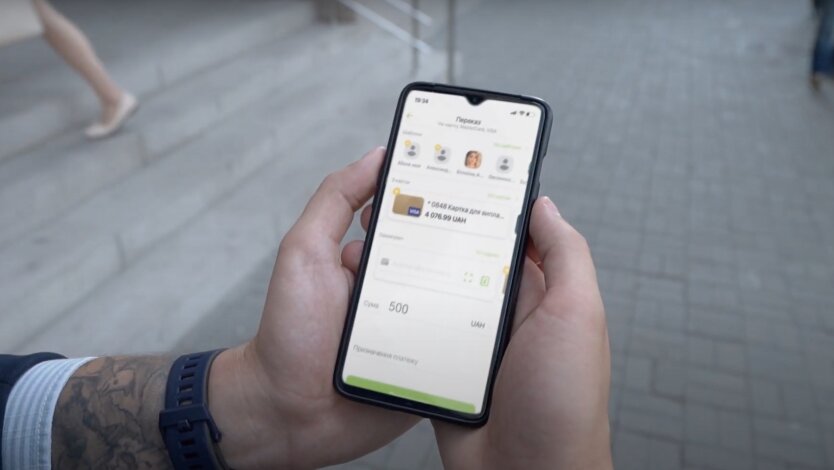

- New Opportunity for Entrepreneurs: PrivatBank Simplified Key Procedure

- Transition from dollar to euro: NBU names timelines, and IMF - conditions

- Not only tax: who else will gain access to the banking secrets of Ukrainians

- Blood group linked to early stroke risk: study results

- Zelensky confirmed the death of the commander of the 110th Mechanized Brigade, Zakharievich, as a result of a missile strike

- The former head of the Brovary TCC was found to own elite real estate and a fleet of vehicles